The much-anticipated GIPF Pension-Backed Home Loan Scheme will commence on Monday next week.

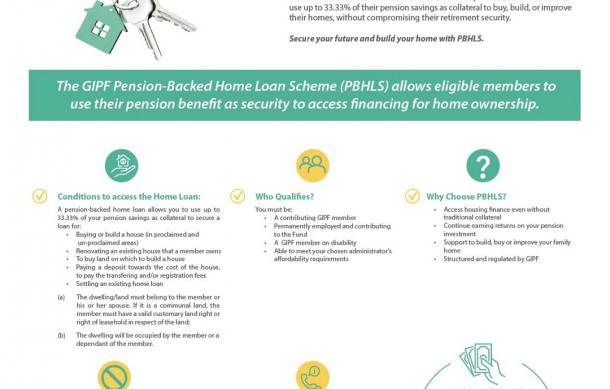

The scheme will enable GIPF active members to access a portion of their pension savings as collateral for the purchase of an erven, make improvements to an existing home, purchase a new home, and/or construct a new home in both urban and rural areas.

Currently, the scheme is only available to current government employees who are contributing monthly towards their pension and members on disability.

GIPF General Manager: Marketing & Stakeholder Engagement Edwin Tjiramba explained that other participating employers, such as State Owned Enterprises, will not be notified in due course when the scheme will be available after the finalisation of various memoranda of agreement.

“This is something we hope to do within the next two months or so, so that their staff members can also benefit from the fund. So who is eligible? Eligibility is that you have to be an active member, so basically, our pensioners are not eligible for the fund.”

The pension-backed housing loan will not be granted for the purposes of consolidating debt, but for the purposes of acquiring immovable properties.

The scheme will also enable members to transfer their existing home loans, which are currently financed by other financial institutions or commercial banks, to this new scheme.

Members can borrow up to 33.3% of their pension savings as recommended by the fund's actuary to enable long-term sustainability of the fund.

“What is sustainable for the fund going forward is that the members may borrow up to a third of their pension savings. We are looking basically at your withdrawal amount, which we say is your cash savings. So to give a typical example, if that amount in your account is N$900,000, that means for this scheme you are eligible to borrow up to N$300,000.”

By law, the Pension Fund Regulations state that all loans will be charged a variable interest rate equivalent to the prevailing repo rate plus 2.5%.

Members are further advised to access their benefit statements via the member portal on the GIPF website to ensure that their qualifying amounts correspond with their latest income.