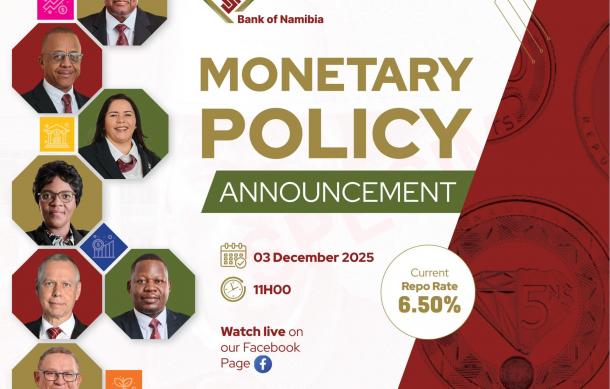

The Monetary Policy Committee (MPC) of the Bank of Namibia has decided to keep the repo rate unchanged at 6.5%.

The Governor of the Bank of Namibia, Johannes !Gawaxab, announced this during the final Monetary Policy Announcement of the year.

In determining the appropriate monetary policy stance, the Committee noted prolonged global policy uncertainty and potential risks to the domestic economy.

!Gawaxab further noted that the formal adoption of the 3% inflation target by South Africa necessitated additional vigilance in managing domestic inflation to ensure the continued smooth functioning of the exchange rate peg.

"Commercial banks are accordingly expected to keep their prime lending rates at 10.125%. This policy stance is deemed appropriate for safeguarding the one-to-one link between the Namibia Dollar and the South African Rand, while remaining supportive of domestic economic activity."

The central bank highlighted that the overall environment remains positive, with both current and projected inflation well contained and growth set to recover in the medium term.

"While capital flows were assessed to be orderly and the MPC was gratified by the smooth redemption of the Eurobond, narrowing the interest rate differential with South Africa was equally deemed essential. The normalisation of the prime-repo rate spread, anticipated by the end of the year, is expected to provide further support to the domestic economy, bringing the level of the prime rate to 10.00%."

The next Monetary Policy Committee meeting will be held next year in February.